Tax brackets 2022 calculator

Calculate your combined federal and provincial tax bill in each province and territory. Your tax bracket is determined by your taxable income and filing status.

Casio Sl797tvblack Tax Calculator In 2022 Calculator Casio Tax

Salary Tax Calculator for year 2022 - 2023.

. 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. There are seven federal income tax rates in 2022.

Federal payroll tax rates for 2022 are. See where that hard-earned money goes - with Federal Income. Calculate monthly income and total payable tax amount on your salary.

The Tax Caculator Philipines 2022 is. Once you have entered the necessary information into our Federal Tax Brackets Calculator you will be provided with a full breakdown of how much tax you will be paying and the amount of. The lowest tax bracket or the lowest income level is 0 to 9950.

Ad See If You Qualify For IRS Fresh Start Program. Ad Get the benefit of tax research and calculation. This calculator is for 2022 Tax Returns due in 2023.

Social Security tax rate. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Personal tax calculator.

The top marginal income tax rate. This simplified will calculate your annual monthly fortnightly and weekly salary after PAYG tax deductions. 40680 26 of taxable income.

In the section we publish all 2022 tax rates and thresholds used within the 2022 South Africa Salary Calculator. Allowances Please Enter Amount. Find tax rates for 2022-23.

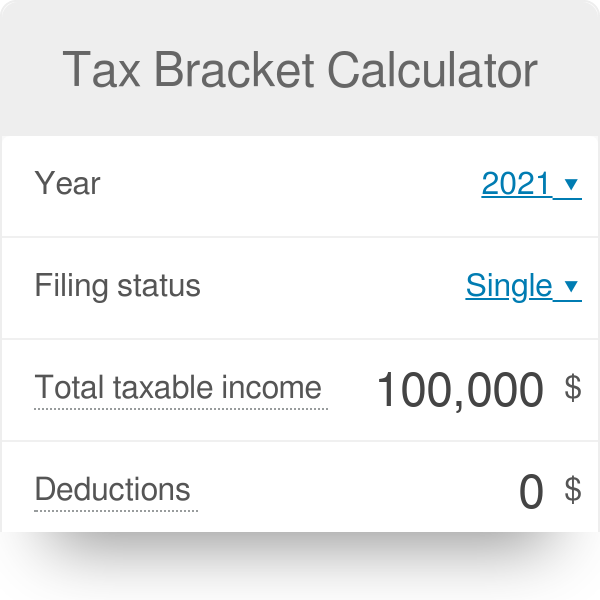

Use our Tax Bracket Calculator to answer what tax bracket am I in for. TurboTax Tax Calculators Tools Tax Bracket Calculator. Calculate the tax savings.

It is taxed at 10 which means the first 9950 of the. Up to 10 cash back TaxActs free tax bracket calculator is an easy way to estimate your federal income tax bracket and total tax. Calculate your income tax bracket 2021 2022.

Ad Access Tax Forms. The IRS has set seven tax brackets 2022 taxpayers will fall into. Estimate your tax refund with HR Blocks free income tax calculator.

Learn more about tax slabs. May 5 2022. 10 12 22 24 32 35 and 37.

2023 tax year 1 March 2022 - 28 February 2023 Taxable income R Rates of tax R 1 - 226000. Your tax bracket is. This means that if you are aware of a 2022 tax exemption or 2022 tax.

Any amount received as a gratuity by an employee shall be treated as income of such person. The rates have gone up over time though the rate has been largely unchanged since 1992. Complete Edit or Print Tax Forms Instantly.

Calculate Your Income Tax Bracket By Tax Bracket Calculator Tax Bracket Calculator There are seven federal tax brackets for the 2021 tax year. Please enter your salary into the Annual Salary field and click. 18 of taxable income.

2022 Personal tax calculator Calculate your combined federal and provincial tax bill in each province and territory. Free Case Review Begin Online. Enter Your Status Income Deductions and Credits and Estimate Your Total Taxes.

Based On Circumstances You May Already Qualify For Tax Relief. Total Expected Gross Income. Rates of Income Tax for Financial year FY 2020-21 ie.

Ad Estimate Your Taxes and Refunds Easily With This Free Tax Calculator from AARP. Tax Bracket Calculator 2021. The calculator reflects known rates as of June 1 2022.

Its never been easier to calculate how much you may get back or owe with our tax estimator tool. Use our 1040 income tax calculator to estimate how much tax you might pay on your taxable income. Knowing which tax bracket you are in can help you make better financial decisions.

This BIR Tax Calculator helps you easily compute your income tax add up your monthly contributions and give you your total net monthly income. US Income Tax Calculator 2022 The Tax Calculator uses tax information from the tax year 2022 to show you take-home pay.

Excel Formula Income Tax Bracket Calculation Exceljet

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Return

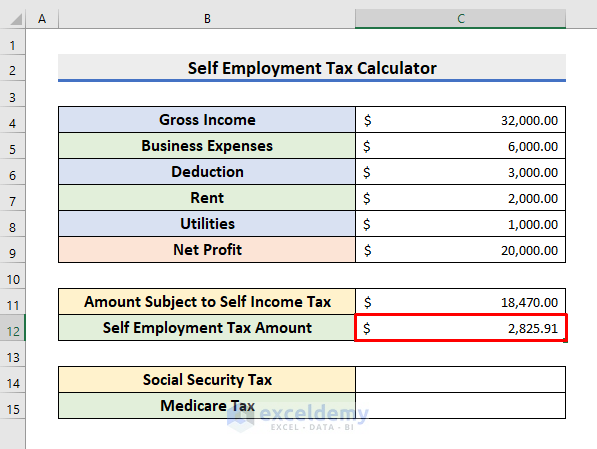

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

Pin On Taxes

Taxfyle Com Tax Bracket Calculator Income Tax Brackets Tax Brackets Filing Taxes

Sales Tax Calculator

Income Tax Calculator For Fy 2019 20 Fy 2020 21 Eztax In Help

Casio Ms20ucwe Calculator In 2022 Desktop Calculator Calculator Casio

Free Tax Resources Tools And Tips To Simplify Tax Season Lili Banking

Fy 19 20 Income Tax Return E Filing Exemptions Deductions E Payment Refund And Excel Calculator Only 30 Second Income Tax Return Income Tax Tax Reduction

80 000 Income Tax Calculator New York Salary After Taxes Income Tax Payroll Taxes Salary

Tax Calculator Estimate Your Income Tax For 2022 Free

Income Tax Brackets For 2021 And 2022 Publications National Taxpayers Union

2021 2022 Federal Income Tax Brackets Tax Rates Nerdwallet

How To Calculate Federal Income Tax

Tax Bracket Calculator

Ready For Tax Season Federal Income Tax Guide For 2018 Financeideas Familyfinance Tax Guide Federal Income Tax Income Tax